Every June & December Statistics Canada tallies every active business location in the country, sliced by 2- to 6-digit NAICS, employment-size band, and geography right down to the municipality. The latest release (December 2024) reports:

-

1.36 million employer locations

-

3.48 million non-employer locations (sole proprietors & gig operators with ≥ $30 k revenue)

That’s roughly 2.6 non-employers for every firm with payroll—a key insight when you’re sizing local markets or planning BR&E outreach.

Employer vs Non-employer businesses—what’s the difference?

| Category | How a location qualifies | Typical examples | Key analytic implications |

|---|---|---|---|

| With employees (Employer) | At least one paid employee in the previous 12 months and a Payroll Deduction account remitted to CRA | Incorporated firms, franchises, multi-site chains, staffed retail/industrial operations | Good proxy for local jobs, payroll and commercial floor space |

| Without employees (Non-employer) | No paid employees in the previous 12 months; usually sole proprietorships or incorporated owner-operators with ≥ $30 k annual revenue | Consultants, tradespeople, rideshare drivers, home-based e-commerce sellers | Signals entrepreneurship and “side-hustle” economy; does not translate directly into local employment |

Why the split matters:

-

Employer counts align with job creation, industrial land demand and tax-base growth.

-

Non-employer counts capture freelance and gig-economy activity that boosts household income but often has minimal physical footprint.

-

Combining both tells a fuller story of local dynamism but can inflate “business” totals if you are interested strictly in payroll employment.

Five ways the dataset can strengthen your analysis

-

Granular cluster mapping – Compare the share of, say, 4-digit NAICS 5415 (Computer Systems Design) in your city to peer regions to spot tech-sector momentum.

-

Benchmarks for BR&E – Use employment-size ranges (1-4, 5-9, 10-19… 500+) to flag firms that may be ready for expansion support.

-

Entrepreneurship health check – Rising non-employer counts in professional services often precede future employer growth.

-

Supply-chain resilience – Overlay counts on transportation buffers or import data to see where local inputs are missing.

-

Program targeting – Filter for women-owned export-oriented sectors (e.g., NAICS 313–315 textiles) to justify inclusive-growth initiatives.

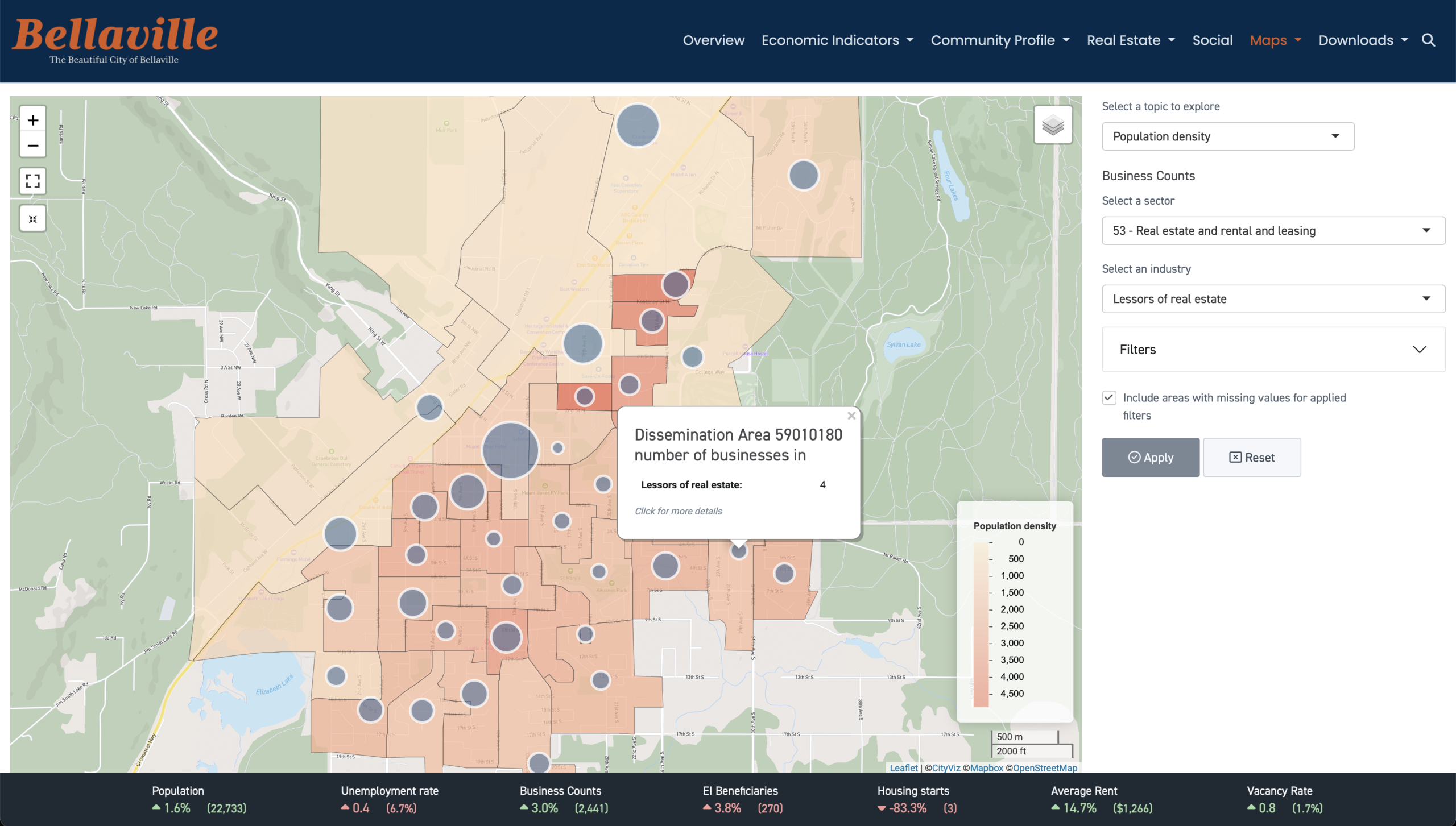

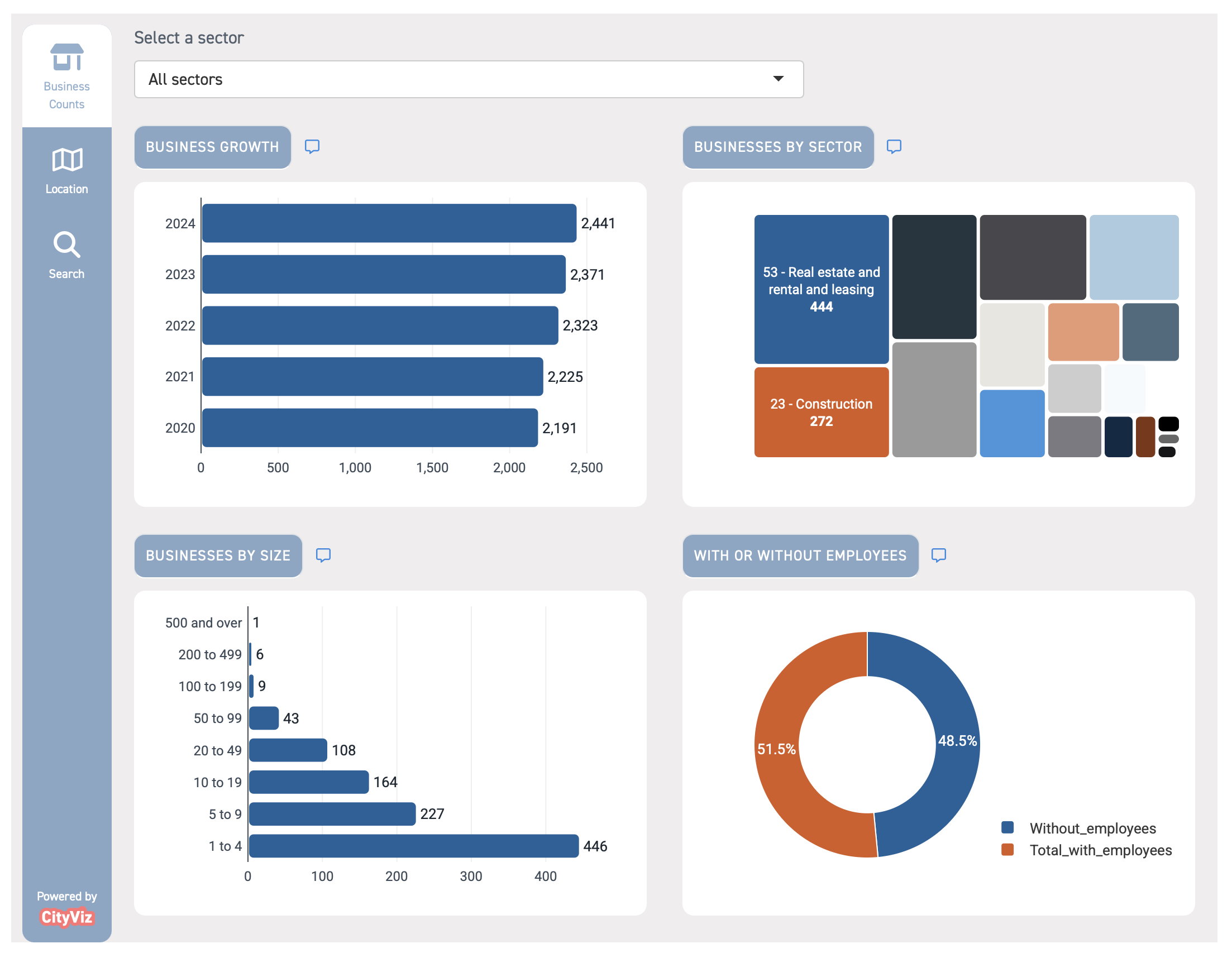

See it in CityViz

We’ve loaded the December 2024 tables into CityViz, and you can explore some ways on our showcase instance how the data platform provides insights into this important dataset.

Explore Business Counts data in details and by neighbourhood.

Jump into the Business Landscape widget, choose your NAICS slice, and map employer vs. non-employer locations side-by-side—perfect for council briefings or investment decks.

Get insights into your community's population outlook

Book a demo or contact us to learn how your community or region is projected to change.